Due to unforeseen circumstances this event is now taking place in a webinar format

A free event hosted by Kerv

Join this webinar to discover how you can be taking advantage of the new consumer duty legislation to make your customer experience better for everyone you serve and support.

Key themes for the day:

- Learn how you can retain and grow your clients whilst delivering a positive outcome through the new consumer duty legislation.

- Hear from Just Group how they are using their CRM plus speech and text analytics to flag their vulnerable customers, and their aspirations to use Copilot to streamline processes.

- Deliver the right customer experiences to your vulnerable consumers by utilising AI and Data: linking your contact centre and CRM (a live demonstration of Genesys Cloud & Microsoft Dynamics 365).

- Provide a streamlined customer and user experience while ensuring compliance through joined-up tech and AI.

Agenda:

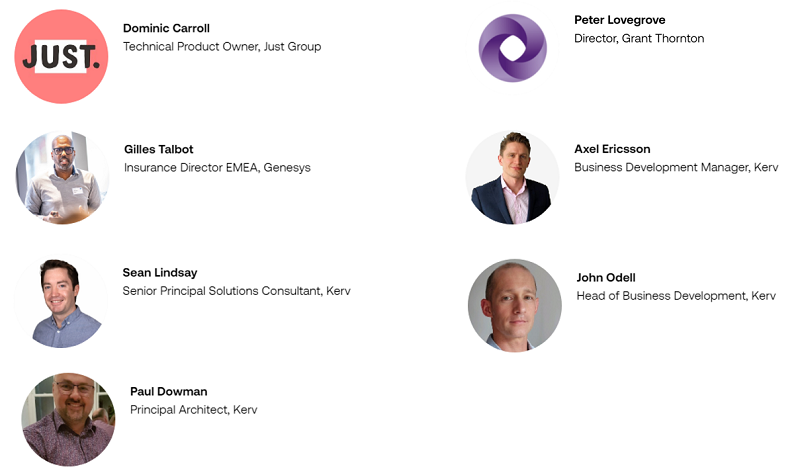

09.30: Welcome and speaker introduction

09.35: Grant Thornton: What does the new Consumer Duty legislation by the FCA really mean for FS organisations and how do they get ahead of them to avoid penalty?

09.55: Hear the Genesys view on the new legislation and how they have invested in their technology to ensure their FS customers can deliver the right level of support.

10.10: Discover how linking your CRM and contact centre allows your agents to deliver the right experience to your consumers by providing them with the data and tools they need.

10.30: Just Group will share how they are using CRM and speech and text analytics to flag their vulnerable customers and their aspirations to use Copilot to streamline processes.

10.40: Q&A – your questions answered.

11.00: Close

.png)

Date:

Date:

Thursday, 26th September 2024

.png) Timings:

Timings:

09:30 - 11:00

Cost:

Cost:

Free to attend

Register:

Register:

Complete the online form to secure your place.

Contact:

Contact:

Please direct any enquiries to Jas Bansal - jas.bansal@kerv.com

At Kerv, we leverage the power of technology to help our customers stay ahead, providing end-to-end cloud solutions and digital transformation.

Event Summary

- Thursday, 26 September 2024

- 09:30 - 11:00

- Free to attend

.png?width=897&height=710&ext=.png)